As an insurance agency owner, you may wonder how much your business is worth and what factors affect its value. Whether you are planning to sell your agency, buy another one, or pass it on to the next generation, knowing your agency’s value can help you make informed decisions and maximize your return on investment.

What’s your insurance agency worth?

Agency owners tend to measure their success in terms of the size of their book of business. That’s a familiar quantifier to agents and it’s easy to access. However, it’s a very limited measure, because it only includes your clients and their recurring payments. The actual value of your agency in the marketplace is impacted by a variety of other factors and the method used to value the agency.

What is the basis of valuation in insurance?

Two similarly sized agencies in the same market could have wildly different values to buyers. How can that be? There are many different factors that weigh into the value of your agency, such as:

- The size, location, growth, and profitability of the agency

- The quality, diversity, and retention of the client base

- The type, mix, and commission rates of the products sold

- The reputation, brand, and market position of the agency

- The strength, skills, and loyalty of the staff and producers

- The operational efficiency, systems, and processes of the agency

- The potential risks, liabilities, and opportunities for the agency

Therefore, the basis of agency valuation includes the value of the book of business plus the additional factors mentioned above.

How to value an insurance book of business

If all you want to know is the value of your book of business, you can use one of two methods. The first is what’s called a revenue multiplier, in which the total annual revenue generated by the book of business is multiplied by a specified percentage. This method is often used when a sale is limited to the book of business itself, and not the entire agency.

The second method is similar, but focuses on a multiplier based on cash flow, namely EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). One way to calculate EBITDA is to add net profit, interest on debts, depreciation, amortization, income taxes paid by the agency, the owners’ total compensation, and any nonrecurring expenses.

Regardless of the method used, other factors that impact the value of the book of business include:

-

-

- The size, growth, and profitability of the book

- The type, mix, and commission rates of the policies sold

- The quality, diversity, and retention of the clients

- The renewal rate, cross-selling potential, and referral opportunities of the book

- The competitive advantage, market demand, and regulatory environment for the products sold

What are some other things insurance agency buyers look for?

When looking beyond an agency’s book of business to establish a valuation, buyers tend to look at several other aspects of the agency’s operations and reputation. Most buyers hope to see a focus on organic growth, with evidence of how well you attract new customers, increase customer loyalty, and inspire customers to become raving fans who tell others about you.

What is a good EBITDA for an insurance agency?

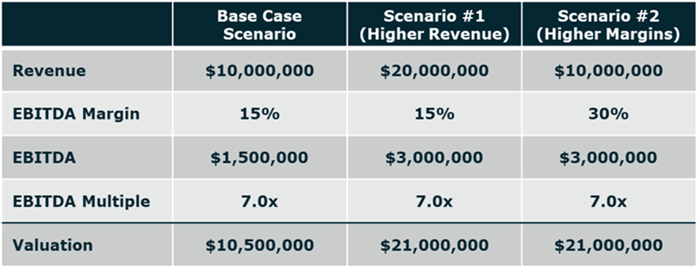

There’s no universal multiplier, because each agency is unique. A good EBITDA for an insurance agency depends on various factors, such as the size, growth, and profitability of the agency, the type, mix, and commission rates of the products sold, the operational efficiency, systems, and processes of the agency, and the industry and market benchmarks. A higher EBITDA typically indicates a more profitable and valuable agency. According to MarshBerry, today’s average EBITDA margins are between 15 and 20 percent, with high-performing agencies demonstrating margins in the 25-to-30-percent range. Smaller agencies typically sell for 4 to 6 times their EBITDA, while agencies larger than $1 million typically fetch 5 to 8 times EBITDA.

(Example assumes a 7.0x EBITDA multiple. Individual results may vary.)

Current EBITDA multiples for insurance agencies

According to the MarshBerry M&A Trends Quarterly M&A Market Update, average multiples for insurance agencies have remained relatively level since 2021, hovering around 10.6.

As an example, let’s say your agency’s revenues approach $10 million annually and your EBITDA margin is at 15 percent. Multiply the two, and your EBITDA is $1.5 million. If the current trend is for agencies like yours to sell at 10.6 times EBITDA, the market value of your firm is $15.9 million. If the multiplier is only 7 times EBITDA, your agency is worth just $10.5 million.

Conclusion

Insurance agency valuation is not a simple or straightforward process. It requires a thorough analysis of various factors that affect the value of an agency and a careful application of different methods and sources to obtain a reliable range of estimates. Knowing your agency’s value can help you make strategic decisions and achieve your goals.

/Resources%20Thumbnails%20(75).png?width=600&height=314&name=Resources%20Thumbnails%20(75).png)