.png?width=600&height=314&name=Resources%20Thumbnails%20(95).png)

Every year at the family reunion one thing is certain: grandma’s famous potato salad. What makes it famous? No one knows for sure because grandma won’t share the recipe. The aunts have all tried to recreate the recipe, but it’s not the same. The recipe lives in grandma’s mind and if there was ever a written copy, it is long gone. Will grandma share her recipe, or will it be lost forever?

After some convincing, grandma hosted the aunts in her kitchen to teach them the secret of her famous potato salad. Now, the recipe will live on long after grandma, and future generations will get to enjoy her potato salad.

The Secret Sauce

Some business owners feel their company has the secret sauce to success. They’ve perfected their winning recipe of client experience, employee engagement, and business management. However, as they near retirement, will those secrets go with them? In order for the legacy to continue, these owners must share their recipe and train the next generation for success. If you’re a business owner with the secret sauce or an employee looking to learn the recipe, here are some best practices.

Planning for Succession

Succession is an emotional transition. The owner has invested years, sweat, and tears into their business and letting it go may be difficult. They may wonder if their successor will value the business as much as they did. The employee looking to take over the business may be overly eager to take over the business and become impatient with the owner’s hesitancy. Because of this, it is vital that business owners begin succession planning early. Most experts agree planning should begin at least five years before the expected succession. This allows everyone enough time to identify their goals for the succession and determine the deal structure that is most beneficial.

Identify Goals

The current and future business owners likely have different opinions about the best way to handle the succession. It is important that both parties write down their goals for the succession and involve experts in succession planning such as legal and financial counsel to provide guidance. A succession is a major event, so having a team of individuals with experience will be vital.

Get an accurate valuation

One of the main areas that experts can provide guidance in is the valuation of the business. The current owner has a strong attachment to the business and expects to receive compensation for what he or she feels the business is worth. Their successor may feel less attached to the business and want to pay less. A third-party valuation is the surest way to settle on a fair valuation on the firm that takes the emotion out of the equation.

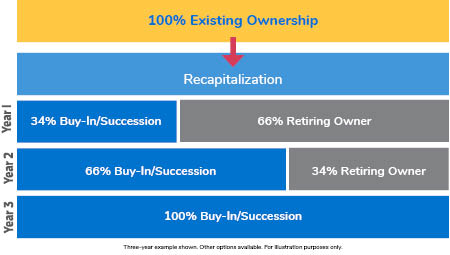

Deal structure

Another important piece of a succession plan that both parties should determine early on is the deal structure. There are a variety of ways the current owner can exit the business. He or she may want a one-step exit with a lump cash payment. Or they may prefer a phased succession over a few years. The succession payment may include an earnout or a seller note. There are pros and cons for each method from a tax standpoint that both sides should consider. A tax expert with experience in succession planning will be able to provide direction to the deal structure that works best for everyone.

Communication

Communication is very important for everyone impacted by the succession. If an employee aspires to own the company one day, he or she should begin talking with the current owner soon. The owner may not be aware a particular employee is interested in owning the business, but once they have identified prospective successors, they can begin to teach and train the next generation.

The current owner should also communicate early with stakeholders, employees, and clients. This will help set proper expectations and stifle misinformation. Early communication is especially important for owners who are hesitant to leave the business, because they are fearful the business will crumble after they leave. These owners should take the opportunity to reassure employees and clients that the new owner has their full backing and that he or she will have their best interests in mind during the transitions. Communication with the clients is critical to keep them from leaving the firm when the current owner leaves. If the current owner has successfully taught the next generation their secrets to success, the clients will not experience a change in the service levels they’ve come to expect.

Conclusion

Just like grandma, some business owners may be reluctant to pass on their secrets to the next generation, but it is necessary for the continuation of the legacy. By beginning to plan their succession early, business owners can ensure their legacy is passed on to whom they wish and how they wish.

.png?width=600&height=314&name=Resources%20Thumbnails%20(95).png)

/Resources%20Thumbnails%20(75).png?width=600&height=314&name=Resources%20Thumbnails%20(75).png)