Selling An Insurance Agency: A Guide to Selling with Success

November 17, 2023 •Oak Street Funding

There are many reasons you may consider selling an insurance agency. It could be that you’re ready to retire and want to be reimbursed for your years of work in growing your book of business. Maybe your goal is to gradually transfer ownership of the agency to your children or other employees. You might even hope to divest one of your offices or lines of business so you can focus your energy on other areas.

No matter why you're selling an insurance agency, it's important to understand everything that's involved in the process and the steps you can take to ensure you receive the greatest value for your business. We'll explore the many facets of selling an insurance agency and provide practical guidance based on our experience of working with other insurance agency owners.

Table of Contents

1. Understanding the value of your insurance agency

2. What is the basis of valuation in insurance?

3. How to value an insurance book of business

4. Preparing your insurance agency for sale

5. Finding potential buyers for your insurance agency

6. Negotiating the terms of the sale

7. Due diligence process for selling an insurance agency

8. Closing the sale and transitioning ownership

9. Legal and financial considerations when selling an insurance agency

10. Common challenges and pitfalls to avoid when selling an insurance agency

Understanding the value of your insurance agency

Before selling an insurance agency, the most important thing you need to know is what your agency is worth. You may have your own idea of your agency’s value, but what you need to know is what the market and potential buyers will be willing to pay for it. With an accurate valuation, you’ll be able to make informed decisions that will help you maximize the return on the investment you’ve made.

Agency owners tend to measure their success in terms of the size of their book of business. While familiar, that’s a very limited measure, because it only includes your clients and their recurring payments. The actual value of your agency in the marketplace is impacted by a variety of other factors and the method used to value the agency.

→ 5 Ways to Stand Out When Selling an Insurance Agency

What is the basis of valuation in insurance?

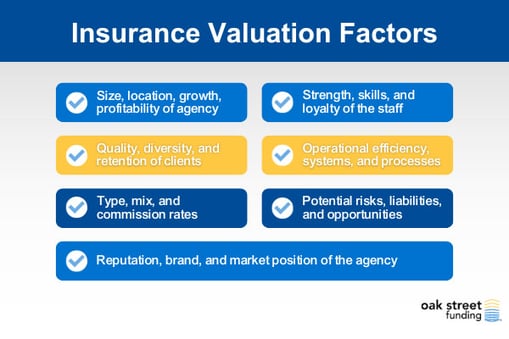

Two similarly sized agencies doing business in the same market could have wildly different values. How can that be? Many different factors weigh into the value of your agency, such as:

- the size, location, growth, and profitability of the agency

- the quality, diversity, and retention of the client base

- the type, mix, and commission rates of the products sold

- the reputation, brand, and market position of the agency

- the strength, skills, and loyalty of the staff and producers

- the operational efficiency, systems, and processes of the agency

- the potential risks, liabilities, and opportunities for the agency

While conversations about an insurance agency’s value typically begin with the book of business, they quickly expand to incorporate all of these factors. If you put yourself in the place of someone willing to make a significant investment in what you've built and managed, it makes sense.

How to value an insurance book of business

If all you want to know is the value of your book of business, you can use one of two methods.

Revenue Multiplier

The first is what's called a revenue multiplier, in which the total annual revenue generated by the book of business is multiplied by a specified percentage. This method is often used when a sale is limited to the book of business itself and not the entire agency.

EBITDA Multiplier

The second method is similar. It focuses on a multiplier based on cash flow that’s known as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). You can calculate EBITDA by totaling your agency’s net profit, interest on debts, depreciation, amortization, annual income taxes paid by the agency, the compensation earned by you and any other owners, and any nonrecurring expenses.

What is a good EBITDA for an insurance agency?

Unfortunately, there’s no universal multiplier, because while insurance agencies may perform similar activities, each agency is structured, staffed, and operated differently. Choosing the right multiplier depends on various factors, such as the size, growth, and profitability of the agency; the type, mix, and commission rates of the products sold; the operational efficiency, systems, and processes of the agency; and commonly accepted industry and market benchmarks.

Generally, a higher EBITDA typically indicates a more profitable and valuable agency. According to MarshBerry, today’s average EBITDA margins for insurance agencies fall between 15 and 20 percent, with high-performing agencies achieving margins in the 25-to-30-percent range. Smaller agencies typically sell for 4 to 6 times their EBITDA, while agencies larger than $1 million typically fetch 5 to 8 times EBITDA.

How does this work in practice?

Say your agency’s revenues approach $10 million annually and your EBITDA margin is at 15 percent. Multiply the two, and the value is $1.5 million. If the current trend is for insurance agencies like yours to sell at 10.6 times EBITDA, multiplying the two numbers results in an approximate market value of your firm of $15.9 million. If the multiplier is only 7 times EBITDA, your agency is worth just $10.5 million.

→ How to Know What Your Agency Is Worth

Preparing your insurance agency for sale

The EBITDA multiplier only provides an approximation of what your agency is worth based on other sales of comparable agencies. When selling an insurance agency, you need to obtain a realistic valuation for what others in the marketplace may be willing to pay.

Professional appraisers generally use some combination of approaches focused on market multiples of revenue, assets under management, and cash flow. Specific valuation terms they use may include:

- Discounted Cash Flow

- Times Revenue

- Earnings Multiplier

- Book Value

- Liquidation Value

- Comparable Company Analysis

- Precedent Transactions Analysis

Get Industry Insights in Your Inbox

Finding potential buyers for your insurance agency

If you wanted to sell your home, you’d probably find a realtor you trust and let them find potential buyers. Selling an insurance agency isn’t quite as straightforward and simple. It’s not like you’re going to post a “for sale” sign out in front of your office, or that someone is going to walk in one day and offer to take the business off your hands.

Some insurance agency owners have used business brokers, but not every business broker has a solid understanding of the insurance business or knows which potential buyers might have an interest.

Oak Street Funding Exchange

An easier option is to use Oak Street Funding’s Agency Exchange. It’s a clearinghouse for owners interested in selling their insurance agencies and people who are in the market to buy agencies. There’s no cost for setting up your own profile with information about your insurance agency … and there’s no cost for prospective buyers to look at your listing.

The OSF Agency Exchange allows prospective buyers to search by geography and see whether any agencies are for sale in areas that interest them. They can review the posted information and request details from Oak Street Funding to begin the acquisition process. If a buyer is interested in your agency, you can use the Exchange to review their information, too. Both buyers and sellers can also sign up to receive alerts as new buyers or sellers join the marketplace.

How to use our Exchange pages

The OSF Agency Exchange is as easy to use as an internet search engine. Whether you’re buying or selling, you simply include the requested information and set the geographic and other parameters that matter to you.

The Exchange will automatically generate a list of available buyers or sellers who meet your specifications. You’ll be able to:

-

- List your agency for sale & receive listing alerts regarding activity on your listing, and

- Search buyer profiles

Negotiating the terms of the sale

There’s no simple answer as to how best to negotiate the sale price for your business. You may be able to find data for recent sales of similar insurance agencies in similar markets. It’s also a good idea to look to your CPA and attorney for guidance about a reasonable sale price.

Due diligence process for selling an insurance agency

Once you’ve reached a tentative agreement with a buyer, expect to go through several steps before the sale transaction can be finalized. The most important is due diligence, in which the buyer studies your business thoroughly so they can verify any representations you’ve made.

→ Buyer and Seller Protections During an Acquisition*

Closing the sale and transitioning ownership

It’s in everyone’s best interests for the transition to the new owner to flow as smoothly and seamlessly as possible. The more everything appears to be business as usual, the happier your customers are going to be. In fact, a smooth transition is a critical element in retaining employees and customers long after the deal is done.

Legal and financial considerations when selling an insurance agency

Because insurance agencies are required to comply with the rules of government bodies and regulatory agencies, it’s important to address those situations as you begin and proceed through the sale process. You’ll want to review a variety of factors that may include:

Regulatory compliance

You’ll need to become familiar with any regulations your state and locality may have for insurance agencies and selling them. There may not be any, or it may be as simple as notifying a government agency when ownership changes.

Agency licensing

Similarly, most jurisdictions require some type of licensing for insurance agencies. Depending upon the particular area’s rules, separate licenses may be required for each line of insurance the agency sells. Your state may require one license for selling life insurance and a separate one for property and casualty coverage. Not only is it important for you to be in compliance, but buyers must also comply with applicable regulations.

Staff licenses

In addition to agency licenses, most states require employees such as brokers, producers, and even customer service representatives to obtain licenses. Before listing your insurance agency for sale, it’s a good idea to verify that all staff members are properly licensed.

Customer accounts

The prospective owner needs to be apprised of any arrangements under which portions of the book of business are not owned directly by the agency. This might include situations in which the carrier considers the insureds to be their customers and not yours, or when “employees” are actually independent contractors who retain control of the accounts they handle.

Compensation arrangements

Similarly, a prospective buyer needs to be made aware of how your insurance agency structures employee compensation. Are your team members paid hourly, by salary, through commission, or some combination? In smaller agencies, it’s not unusual for different team members to be compensated in different ways.

Lender requirements

Some loans and lenders may come with specific legal considerations, such as covenants required for certain employees and any intellectual property. Lenders may also want to be made aware of any anticipated changes in how the agency will operate, such as staff members who choose not to work for the new owner.

Common challenges and pitfalls to avoid when selling an insurance agency

If you’ve done the due diligence described in this article and have kept your trusted advisors in the loop as the process moves along, you’re not likely to experience any unexpected roadblocks or surprises. It is important to go into the insurance agency sale process with a realistic understanding of how long it’s going to take so you don’t make commitments you can’t keep.

Most of all, you need to be confident that you’re ready to sell and prepared for life after the sale is complete. You’d be surprised how many sales were derailed after owners decided they really weren’t ready to stop working. Sometimes, owners will assume they’ll continue to work for the agency after the sale, only to discover the new owner doesn’t have any interest in retaining their expertise and client relationships. Thinking through every aspect of the sale and your expectations will significantly reduce the chances you’ll regret having sold.

/Resources%20Thumbnails%20(75).png?width=600&height=314&name=Resources%20Thumbnails%20(75).png)